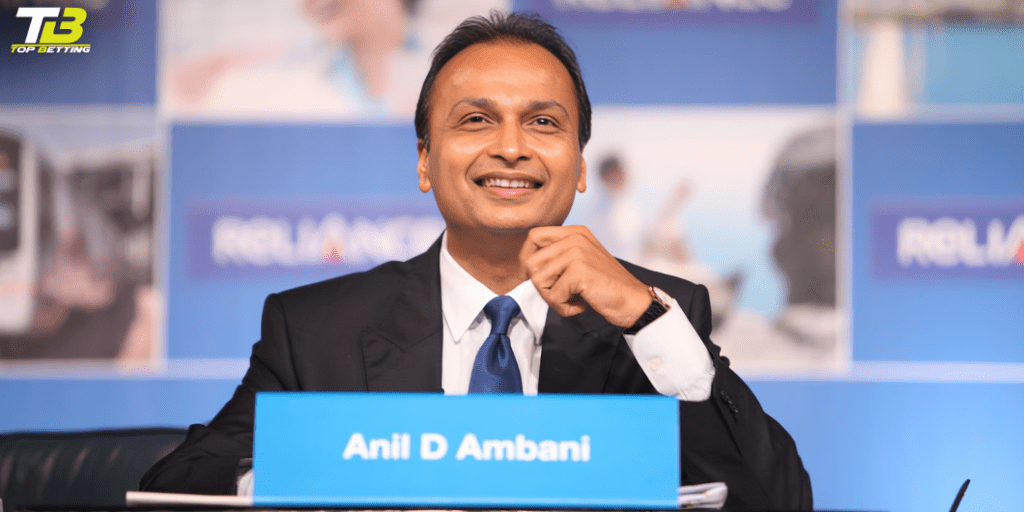

Anil Ambani led Reliance Power shares

Introduction

Reliance Power, led by Anil Ambani, has recently witnessed a surge in its share price, hitting the 5% upper circuit. This development has captured the attention of investors and market analysts alike, prompting a closer examination of the factors driving this significant uptick in share value.

Reliance Power Share price: It was reported that the Anil Ambani-led company settled debts owed to three banks – ICICI Bank, Axis Bank, and DBS Bank.

Shares of Reliance Power rose 5% today (March 20) and reached day’s high of ₹23.83 on the BSE. This comes after it was reported that the Anil Ambani-led company settled debts owed to three banks – ICICI Bank, Axis Bank, and DBS Bank – last week. The reports also claimed that its parent Reliance Infrastructure is working towards settling dues of ₹2,100 crore to JC Flowers Asset Reconstruction Company.

What reports claimed on Reliance Power?

The Economic Times reported quoting a senior executive from a commercial bank as saying, “Reliance Power aims to be a debt-free company by the end of this fiscal year. The only debt on its books will be the working capital loan from IDBI Bank.” Another lender said as per the outlet that three lenders jointly had about ₹400 crore and recovered close to 30-35% of their principal loans.

As per a notice issued to the exchanges on January 7, Reliance Infrastructure and JC Flowers ARC entered into a standstill agreement until March 20, 2024 which was later extended to March 31, 2024 as per which JC Flowers ARC will not take legal action against Reliance Infrastructure until March 31.

Reliance Power financials

Reliance Power disclosed earlier that as of December 31, 2023, its total financial indebtedness stood at ₹765 crore while Reliance Infrastructure stated its total financial indebtedness was ₹4,233 crore for the same period. As per earlier disclosures, Reliance Power settled loans with two lenders- JC Flowers ARC and Canara Bank- in April 2023.

Understanding Reliance Power: Reliance Power is a part of the Reliance Anil Dhirubhai Ambani Group (ADAG), a conglomerate with interests spanning across various sectors including power generation, infrastructure, financial services, and telecommunications. Established in 2007, Reliance Power is one of the leading players in India’s power generation sector, with a diverse portfolio of thermal, solar, and hydroelectric power projects.

Background of Reliance Power:

Reliance Power, a part of the Reliance Anil Dhirubhai Ambani Group (ADAG), is one of India’s leading power generation and coal-based energy companies. Founded in 2007, the company has a robust portfolio of power projects across thermal, solar, and hydro energy sectors. With a focus on sustainable growth and operational excellence, Reliance Power has been a key player in India’s energy landscape.

Factors Driving the Surge:

1. Sectoral Outlook and Policy Reforms:

Renewed Focus on Energy Sector: The energy sector in India is witnessing renewed attention from policymakers, driven by the government’s ambitious targets for clean energy adoption and infrastructure development.

Policy Reforms and Incentives: Favorable policy reforms and incentives aimed at boosting investments in the energy sector have provided a conducive environment for companies like Reliance Power to thrive.

Diversification and Expansion: Reliance Power has been strategically diversifying its portfolio and expanding its presence in renewable energy segments such as solar and wind power. This strategic shift aligns with global trends towards sustainable energy sources.

2. Strategic Initiatives and Expansion Plans:

Project Execution and Operational Efficiency: The company’s focus on efficient project execution and operational excellence has enhanced its competitiveness and attractiveness to investors.

3. Market Sentiment and Investor Confidence:

Positive Market Sentiment: Amidst economic recovery and bullish sentiments in the equity markets, investors are increasingly optimistic about the prospects of companies operating in critical sectors like energy.

Anil Ambani’s Leadership: Anil Ambani’s leadership and strategic vision for Reliance Power may have instilled confidence among investors, leading to increased buying interest in the company’s shares.

4. Financial Performance and Outlook:

Strong Financial Performance: Reliance Power’s robust financial performance, driven by revenue growth, cost optimization measures, and debt restructuring efforts, has bolstered investor confidence in the company’s long-term prospects.

Profitability and Margins: Improvements in profitability metrics and margins, coupled with effective capital allocation strategies, have contributed to the positive perception of Reliance Power among investors.

Conclusion:

The surge in Reliance Power shares, hitting the 5% upper circuit, can be attributed to a combination of factors including sectoral outlook, strategic initiatives, market sentiment, and financial performance. As the energy sector continues to evolve, driven by technological advancements and policy reforms, companies like Reliance Power are well-positioned to capitalize on emerging opportunities and drive sustainable growth. However, investors should remain vigilant and conduct thorough due diligence before making investment decisions, considering the inherent risks associated with equity markets. Anil Ambani-led Reliance Power’s journey exemplifies the dynamic nature of the Indian corporate landscape, where strategic foresight, operational excellence, and market dynamics converge to shape the trajectory of companies and influence investor sentiments.